Right@Home Loan Program: A Path to Affordable Homeownership in Austin

At Open House Austin, we’re committed to helping first-time homebuyers and real estate investors unlock opportunities, especially when it comes to affordable homeownership. One program that aligns perfectly with this goal is the Right@Home loan program offered by Cadence Bank. This unique loan option is designed to help “underserved” borrowers—such as low to moderate-income individuals and minority communities—purchase homes with more favorable terms. Let’s break down how the program works and who can benefit.

What is the Right@Home Loan Program?

The Right@Home loan program is part of Cadence’s efforts to comply with the Community Reinvestment Act (CRA), a federal law that encourages financial institutions to meet the needs of low- and moderate-income neighborhoods. Cadence offers higher Loan-to-Value (LTV) limits, lower rates, and no mortgage insurance requirements to eligible borrowers or properties. These borrowers often include minority individuals or those with lower income, and the program also extends to homes located in low to moderate-income or majority-minority census tracts.

Key Benefits of the Right@Home Loan Program:

• No mortgage insurance required, which can save buyers hundreds of dollars per month.

• No money down for eligible borrowers and properties.

• Below-market interest rates, making homeownership more affordable.

• Forgivable $10,000 second lien for down payment or closing costs, available in some cases.

How to Qualify for the Right@Home Loan Program

There are two main ways to qualify for this loan program—either based on borrower income or based on the location of the property.

1. Income-Based Qualifications

To qualify based on income, your earnings must be 80% or less of the Area Median Family Income (AMFI). In the Austin area (which includes Travis, Williamson, Hays, and Bastrop counties), the 2024 AMFI is $126,000. This means borrowers who earn less than $100,800 annually could qualify for the program.

Eligible borrowers can purchase a home for up to $766,550, with no money down, no mortgage insurance, and access to discounted interest rates. Additionally, Cadence is offering a $10,000 forgivable second lien to help cover down payments or closing costs, which is forgivable after five years.

2. Property-Based Qualifications: Low/Moderate Income Census Tracts

If the property you’re interested in is located in a low or moderate-income census tract, you may qualify for the loan program without any income restrictions. Like income-based borrowers, those purchasing homes in these census tracts can buy properties up to $766,550 with no money down, no mortgage insurance, and below-market rates. The $10,000 forgivable second lien can also be applied to these transactions.

3. Property-Based Qualifications: Majority-Minority Census Tracts

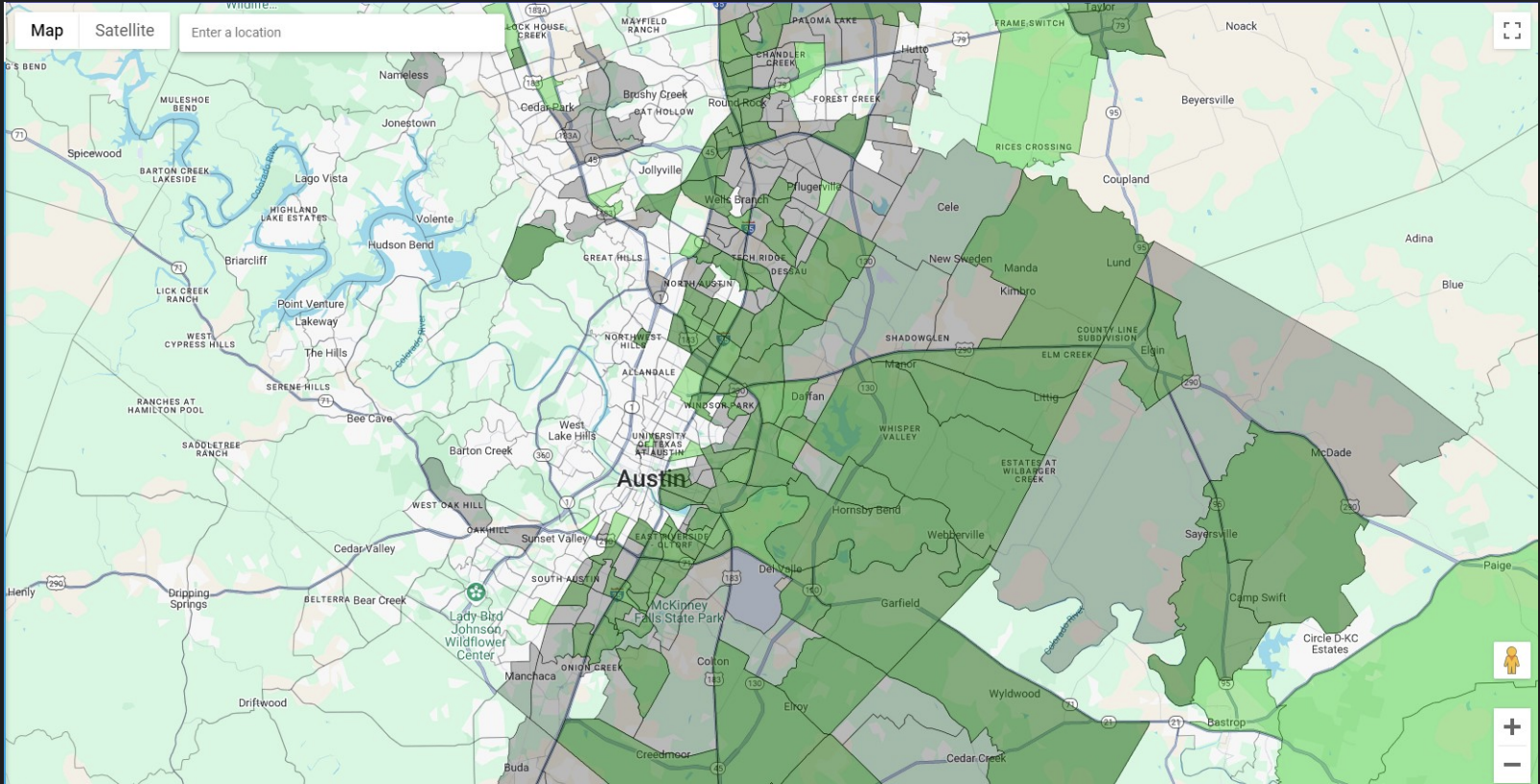

Light green is majority minority tracts, grey is low/moderate income tracts, and the dark green is the overlap of the two

Another route to qualification is if the property is located in a majority-minority census tract (where more than 50.01% of the population is made up of minorities). In this case, borrowers with an income of up to 200% of the AMFI—or $252,000 in the Austin area—can take advantage of this program. You can still buy homes for up to $766,550 with no money down, no mortgage insurance, and access to below-market interest rates. However, the $10,000 forgivable second lien is not available for properties in majority-minority census tracts.

Why the Right@Home Loan Program is a Game-Changer

This loan program is especially beneficial for buyers who may have struggled to secure traditional financing due to income or demographic factors. With the Austin housing market’s rising prices, the Right@Home program provides a crucial opportunity for underserved communities to build wealth through homeownership.

The combination of low down payment requirements, no mortgage insurance, and discounted interest rates can save buyers a significant amount of money over time, helping them achieve their dream of owning a home without the usual financial burdens.

How Open House Austin Can Help

At Open House Austin, we’re here to help you navigate all your real estate options, including innovative loan programs like Right@Home. If you think you might qualify, or want to explore how to make homeownership more affordable in Austin, reach out to us! We’ll guide you every step of the way, ensuring you find the best path to buying your dream home while benefiting from programs designed to support your financial goals.

This comprehensive explanation will help more Austin-area homebuyers discover how the Right@Home program can offer them a smoother, more affordable route to owning property. If you’re interested in learning more, contact us at Open House Austin to get started!