Our 2021 First-Time Home Buyer Stats

Here at Open House, it’s our mission to help first-time home buyers navigate their real estate journey with an investor mindset. We’re here to make the process less scary by sharing the facts - all the facts - so you can make a knowledgeable and informed decision.

We believe that home buying should be inclusive, and we truly want our community to feel educated and empowered. When you work with us, you get an experience that focuses on homebuyer education, community and transparency.

And on the subject of transparency, we’re so excited to share our favorite statistics for our first-time home buyers from 2021! First-time buyers made up 76% of our clients, and we’re so, so proud of them. Despite the market craze, they trusted us to help them accomplish their goals and our numbers show that it is still 100% possible to buy your first home with low money down. The right guidance, education, and team make all the difference. If our clients in Austin can realize their real estate dreams amidst the city becoming the most popular market in 2021, we believe you can do it too!

Keep in mind, the following are numbers from our local Austin agent team. We also work with clients all over the nation - and we can connect you with a realtor who shares our values in your area if you’re looking to buy!

Our Client Demographic

Age Range

The majority of our first-time buyers are between the ages of 25–34. Austin has a young population (median age of 33), and we mostly work with younger clients who want to get into real estate early by house hacking to help supplement their mortgage payment.

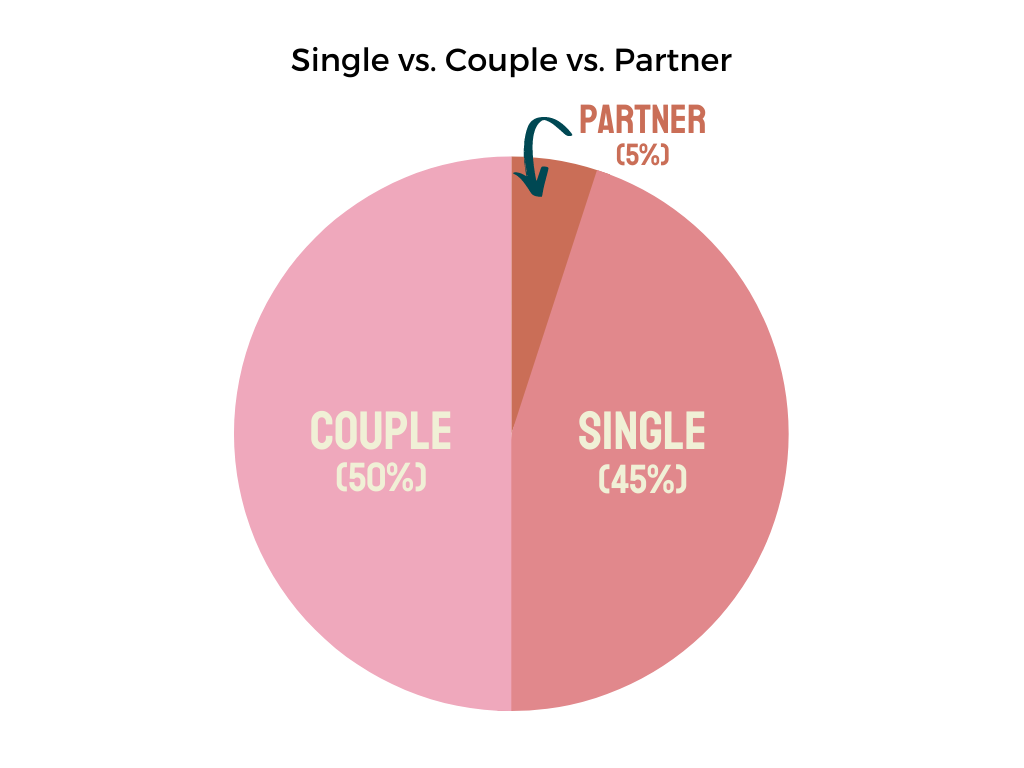

Single, Couple, or Real Estate Partner?

Our first-time buyers were pretty evenly split between buying as a couple (50%) or as a single person (45%). We’re firm believers that being married is NOT a requirement for buying your first home (or any home, for that matter). That’s why we came up with the phrase “Houses Before Spouses”. So many people think about buying their first home in a traditional way - married and ready to settle down! But that doesn’t have to be the case. If you want to live differently, you have to think differently.

We worked with several groups buying as a real estate partnership, which made up that final 5%. This year, we plan to teach our audience more about the best ways to go about partnering with friends and family. Our co-founders Steph and Kristina both attribute all of their real estate success to partnering when buying property!

Special shout out to the two mother/daughter duos who bought together in 2021! That pairing has a special place in our hearts because that’s exactly how co-founder Steph got her start. She partnered with her mom when they were both teachers to buy her first home - and turned that first home adventure into an investment that continues to supplement her income!

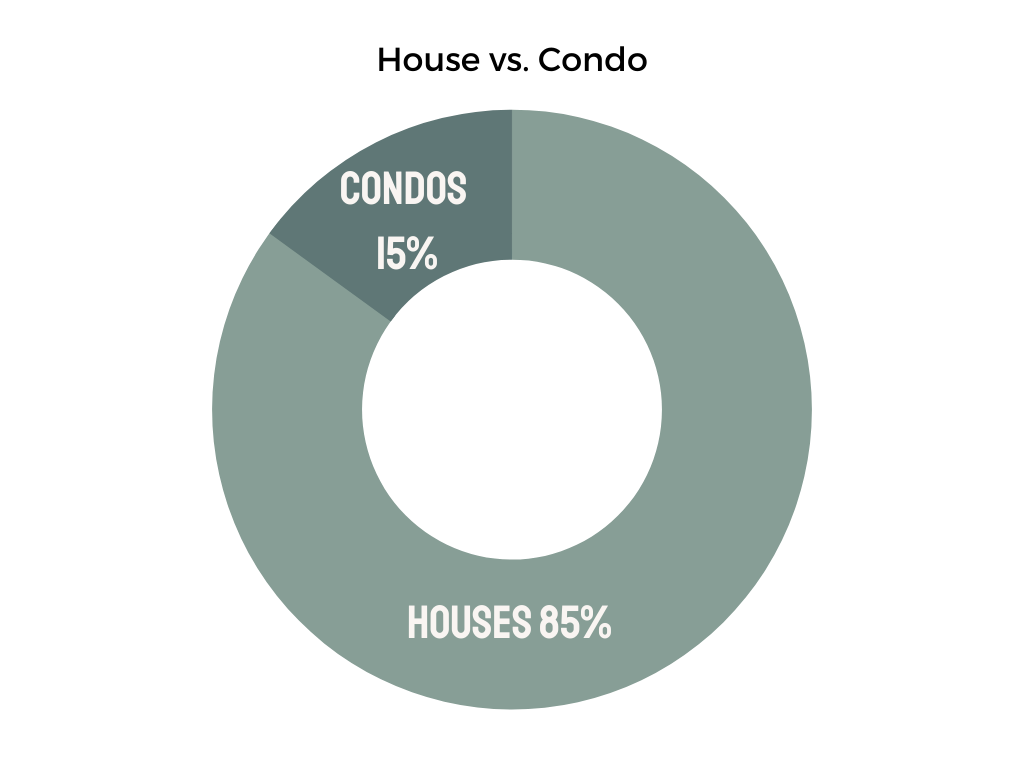

House vs. Condo

Many first-time buyers are attracted to the idea of a condo over a home. Their reasons? They don’t want a lawn to take care of and a condo can appear to be cheaper with a better location within city limits. Condos are tricky though because lenders usually see them as riskier investments - sometimes leading to higher interest rates for the buyer, along with monthly HOA fees. While HOA may cover some of your monthly expenses like lawn maintenance and possibly trash or water, they also can have strict rules and regulations, such as pet restrictions or no short term rentals. It’s not impossible to make it work though!

85% of our clients chose to buy a house, and 15% decided to go with a condo. All of them had to weigh the pros and cons to figure out which worked best for their financial situation and wants/needs. Under the right circumstances, a condo may be the right fit!

Let’s Talk Money

One of the biggest barriers we see in potential first-time home buyers is fear about money. And y’all, we GET IT. A home is a huge expense. But unlike a lot of other big expenses, a home is an investment that appreciates in value over time. When you rent, it can feel like you’re just throwing money away, but a home mortgage payment can be earned back when you sell.

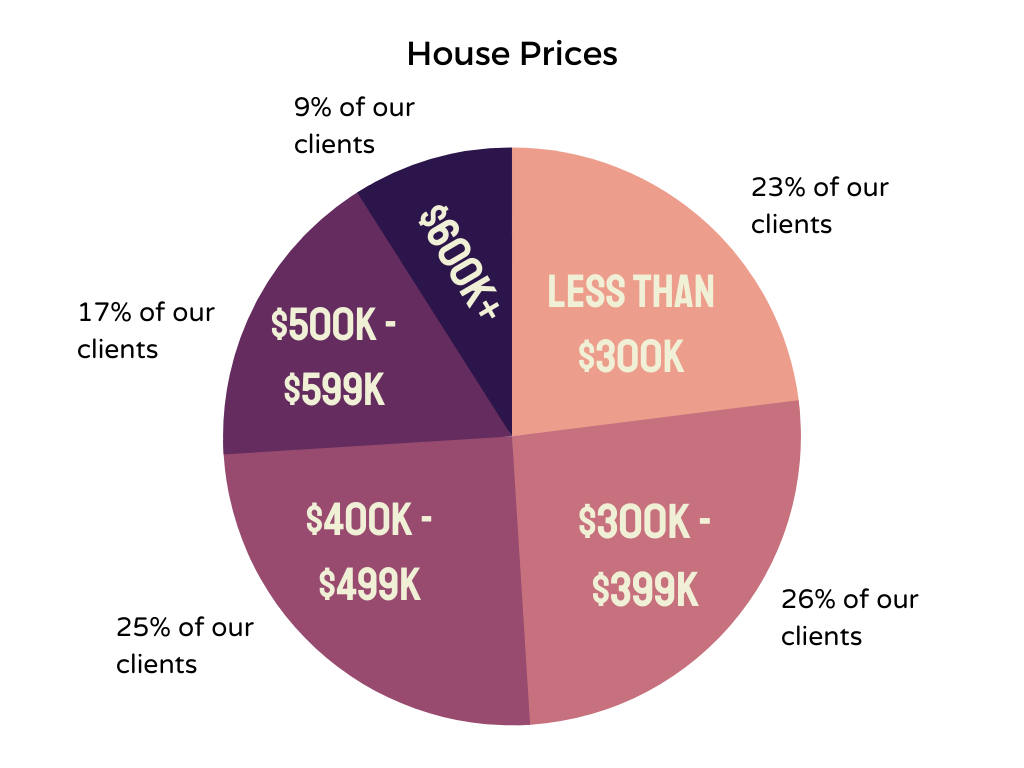

Home Price

So with a property market craze in 2021, how did our first-time buyers do? First, let’s take a look at home prices. Keep in mind, this doesn’t reflect list price. This is what our clients actually ended up paying!

Do those numbers surprise you at all? 49% of our first-time home buyers bought a home for less than $399k. In a crazy market with a median listing price reaching $579k in Dec. 2021, how did they do so well?

Well, the biggest factor (not surprisingly) is LOCATION. Thanks to remote work becoming more common in the past few years, being close to an office is no longer a big factor for buyers. We encourage our first-time buyers to look a little farther in the surrounding suburbs where you can find a larger home for a cheaper price. Some of our clients were even able to utilize a USDA loan with 0% down because they chose a more rural area!

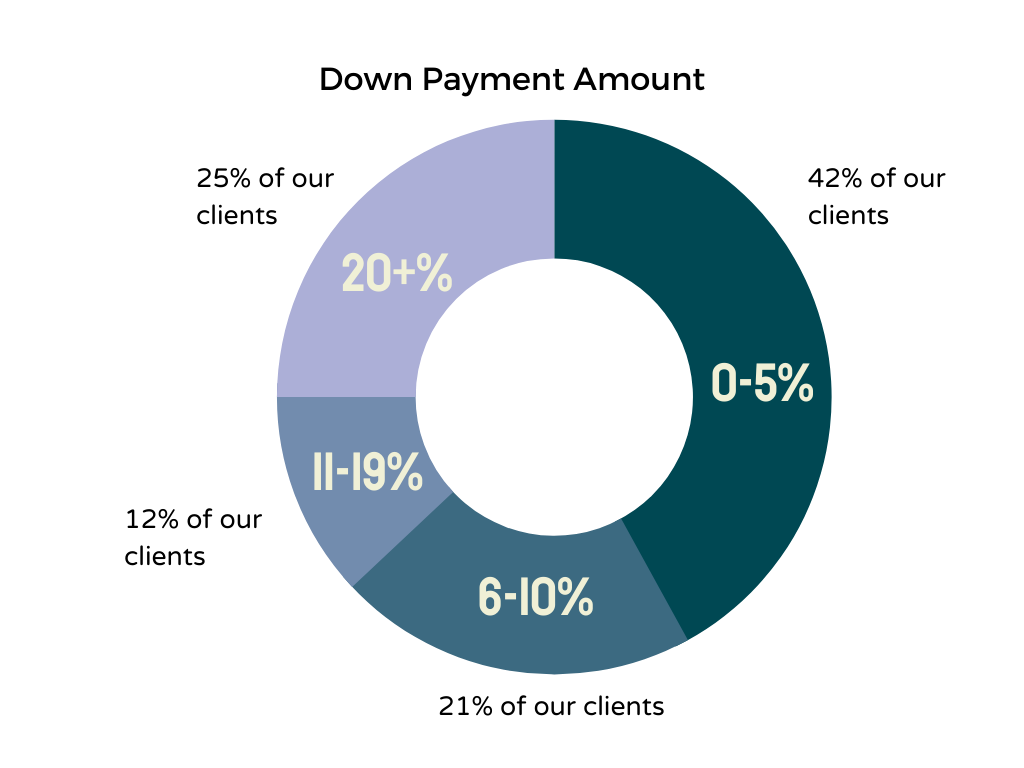

Down Payment & Closing Costs

Now, what about down payment and closing costs? These two numbers are super important because it’s what you actually need in cash to buy. Our clients pay around 1.5-1.75% of total home cost in closing costs, and we don’t see this number change. But down payment, which you as the buyer decide, can vary drastically based on what you’re comfortable with!

One of the biggest misconceptions we continue to see is that a 20% down payment is necessary. And while paying 20% up front will save you from paying PMI, it is NOT necessary, even in a crazy market when you want to win a multiple-offer bid.

So let’s take a look at the down payments our first-time home buyers went with:

42% of our clients put 5% or less down on their first home! In 2021, the National Association of Realtors found the average down payment on a house or condo was just 12%. For home buyers aged 30 and under, that number drops to 6%. We’re proud to beat that number because it means our clients are able to save more of their hard earned money for renovations and making their new place feel truly like home.

What’s Next?

We hope these numbers have given you some insight and hope. There’s a lot of misinformation out there and even more people claiming the market is impossible for first-time buyers. But our experience - and our client stats - say otherwise.

If you’re thinking that this may be your year to buy, we’d love to help you! Our first-time home buyer quiz is a great place to start. If you’re ready to jump in, you can book a call with our agent team in Austin or request a referral for an agent who shares our values in your area - we’ve got connections all over the nation!

Want monthly updates and additional resources? Sign up for our newsletter. You can also find us on Instagram, where we’re constantly posting tips and educational info. Our DMs are always open for questions!

We started Open House to help first-time home buyers navigate their journey. And in 2021, we empowered our clients with education, community and transparency to achieve their goals despite a crazy market! Home buying doesn’t have to be overwhelming. We’re here to help you make sense of it and find a path that truly works for you.