OHA Market Update Series - April 24, 2025

Did you know your LinkedIn profile could impact your mortgage approval? As lenders get more tech-savvy, your online presence—especially on professional platforms—might be used to verify employment, income stability, and financial credibility.

From Home Sweet Home to Smart Investment: How to Turn Your Primary Residence into a Rental

Turning your primary residence into a rental can be a smart financial move, especially in a competitive market like Austin. Whether you're relocating, upgrading, or stepping into real estate investing, renting out your home allows you to retain ownership, build equity, and generate passive income — all while potentially benefiting from tax perks and market appreciation. However, it comes with responsibilities like property maintenance, tenant management, and potential financing challenges. To set yourself up for success, it's crucial to understand local regulations, crunch the numbers, prepare the property, decide on management, and consider working with a real estate professional to navigate the process effectively.

The Truth About Cast Iron Plumbing.

If your home was built before 1975, there’s a strong chance it has aging cast iron plumbing—which could be corroding from the inside out and nearing failure. A professional plumbing inspection, especially with a camera scope, can help identify issues early and prevent costly damage, giving you time to plan and peace of mind.

OHA Market Update Series - April 17, 2025

Single women are outpacing men in homeownership, reshaping the housing market and building generational wealth through financial independence, education, and increased access to mortgage resources.

Want Up to $27,500 Toward Your Down Payment? Here’s How the WISH Grant Works

Looking for down payment assistance in Austin? The WISH Grant Program offers up to $27,500 in free down payment and closing cost support for eligible homebuyers. Whether you’re a first-time buyer or re-entering the market, this 4-to-1 matching grant could be the boost you need to finally own a home in Austin. Funds are limited—book a call with Open House Austin or attend our next homebuyer workshop to learn how to qualify.

OHA Market Update Series - April 10, 2025

Thinking of selling your home in 2025? You might want to mark your calendar: the week of April 13–19 is projected to be the best time to list a home all year, with the perfect mix of high prices, strong buyer demand, and low competition. But don’t worry if you’re not ready by then—spring through early summer is still prime time to hit the market in Austin. If selling has been on your mind, now is the time to start preparing. Let’s make a plan to get your home in front of eager buyers this season!

This Month in Austin - April 2025

It’s springtime and the calendar is in full bloom! The team at Open House Austin has rounded up their favorite events happening in April.

OHA Market Update Series - April 3, 2025

The spring 2025 housing market is showing promising signs for buyers, with more listings, stable mortgage rates, and less pressure to make quick decisions. This shift in the market gives buyers more options and negotiating power, making it a great time to explore homeownership. As rental markets adjust, now could be the perfect moment to consider buying before rents rise again.

March 2025 Fed Meeting: Mortgage Rates Improve & Future Outlook

The Fed held rates steady, and mortgage rates have improved by nearly 0.5% this year, now averaging 6.5%–6.75%. With potential rate cuts expected in June and inflation concerns easing, the market is becoming more favorable for homebuyers. If you’ve been waiting to buy or refinance, now is the time to pay attention. Let’s discuss how you can take advantage!

This Week(end) in Austin - March 27-March 30, 2025

Consider this your official invite to our weekly meeting (without actually having to attend!) where our team of trusted agents share everything from local Austin stuff they’ve recently discovered to happy hours to weekly deals.

OHA Market Update Series - March 27, 2025

Young adults are moving to small towns and rural areas at the highest rate in decades, reversing a long-standing trend of urban migration. This shift, fueled by remote work, rising housing costs in big cities, and a desire for better amenities, is revitalizing smaller communities and driving local economic growth.

Backyard Chickens in Austin, TX: What Homeowners Need to Know

Thinking about raising backyard chickens in Austin? You’re not alone. More and more Austin homeowners are embracing urban homesteading—and chickens are at the top of the list. Whether you’re dreaming of fresh eggs every morning or just want some quirky feathered friends, having chickens in your Austin backyard is totally doable.

At Open House Austin, we love helping buyers find properties that fit their lifestyle—including space for a coop! But before you bring home the hens, here’s what to know about Austin’s backyard chicken rules, zoning, and ideal setups for chicken-friendly homes.

Looking for a home in Austin with room for your future flock? Let’s find your perfect urban farm setup—eggs and all.

OHA Market Update Series - March 20, 2025

Discover the future of homebuilding in Austin's Mueller neighborhood with 3D printed homes by Icon. These sustainable, energy-efficient homes offer innovative designs and affordability, making them an exciting addition to this already thriving community.

Austin’s Music Scene vs. Austin’s Housing Market: Can the “Live Music Capital” Stay Affordable?

How do we make homeownership accessible for musicians and creatives in Austin so it continues to be the Live Music Capital for generations to come?

OHA Market Update Series - March 13, 2025

Looking for an affordable way to become a homeowner? Despite rising costs and limited inventory, starter homes are making a comeback, giving first-time buyers a real shot at owning their dream home. By setting a clear budget, securing pre-approval, and working with an experienced real estate agent, you can navigate the market with confidence and find the perfect place to call your own. Don’t wait—take the first step toward homeownership today!

FHA vs. Conventional Loans: What’s the Difference, and Which One is Right for You?

Trying to decide between an FHA loan and a conventional loan? FHA loans are great for first-time buyers with lower credit scores and smaller down payments, but they come with mortgage insurance that sticks around. Conventional loans offer more flexibility and lower long-term costs—if you qualify. The best choice depends on your finances, future plans, and home goals. Need help figuring it out? Open House Austin has your back!

This Week in Austin - March 12-March 19, 2025

Consider this your official invite to our weekly meeting (without actually having to attend!) where our team of trusted agents share everything from local Austin stuff they’ve recently discovered to happy hours to weekly deals.

OHA Market Update Series - March 6, 2025

Austin has officially surpassed Nashville as the most attractive market for remote workers, according to a new report from Capital Economics. The city’s affordable housing and falling rent prices have made it a top choice for remote employees, especially those in tech. While Nashville still remains a strong contender, Austin’s appeal is boosted by its thriving job market, lower cost of living, and growing number of housing options. Along with Austin, San Antonio has also climbed in popularity, making Texas a dominant player in the remote work housing scene. This shift highlights the growing importance of affordability and lifestyle when choosing where to live and work remotely.

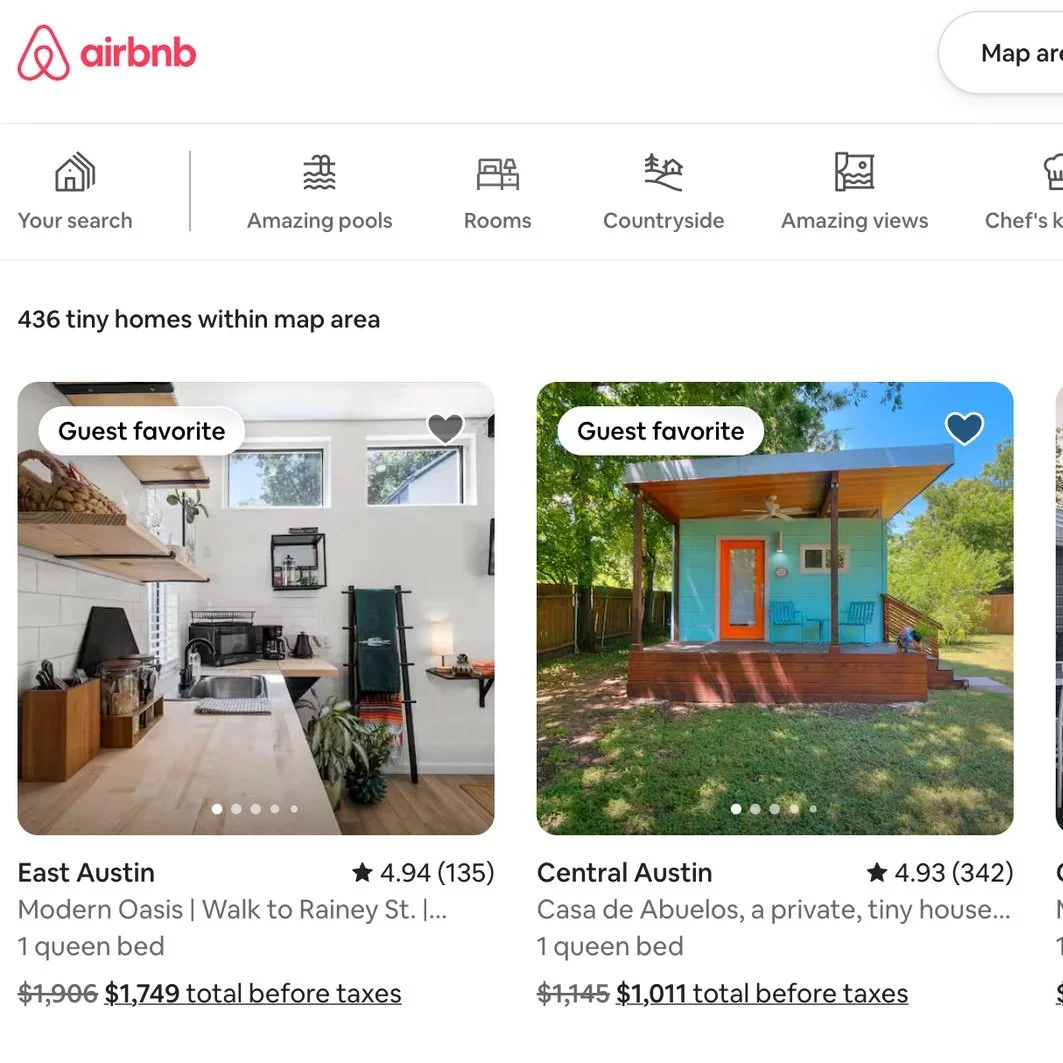

How to Get a Short-Term Rental Permit in Austin, Texas

Navigating the short-term rental (STR) permitting process in Austin can feel overwhelming, but securing the right license is essential for staying compliant and avoiding hefty fines. Whether you’re listing your property on Airbnb or Vrbo, you’ll need to apply for a permit, meet zoning requirements, and adhere to local regulations. In this guide, we break down the steps to get your STR permit in Austin, from submitting your application to understanding tax obligations—ensuring your rental operates legally and hassle-free.

Austin’s Airbnb / Short-Term Rental Rules Are Finally Changing

After years of delays, Austin City Council has finally approved new short-term rental (STR) regulations, aiming to crack down on unlicensed Airbnbs and collect millions in unpaid hotel taxes. Key updates include requiring platforms like Airbnb and Vrbo to collect and remit hotel occupancy taxes and implementing new technology to track illegal rentals.

However, major enforcement measures—like forcing platforms to de-list unlicensed STRs and capping how many a single owner can operate—are still on hold until at least October.

What does this mean for Austin homeowners, real estate investors, and STR operators? Read on to find out how these changes could impact you.