Should You House Hack a Condo or House?

Purchasing a home is an incredibly rewarding experience in one’s life, but it isn’t the easiest decision in the world. You really have to take the time to decide if you are financially ready and figure out exactly what you want out of your home buying experience.

@jordanbauer

At Open House, we are huge proponents of house hacking your home. House hacking is supplementing your mortgage, taxes and insurance (henceforth referred to simply as “mortgage”) with monthly income. You can do this by getting roommates for spare rooms, Airbnb-ing your spare rooms x amount of times per month, or even building a tiny home in your yard for rental income to help pay your mortgage. There are so many ways to get creative when it comes to house hacking!

But when it comes to house hacking - is there a type of home that is best? Should you buy a bigger house that is possibly more expensive and utilize every spare room to supplement your mortgage? Or should you get a cozy condo and find a roommate to occupy your second bedroom? It really comes down to a couple factors that we will explore throughout this post.

But before we go through your options, we have another question:

If the answer was “you’re ready!” then congrats! Let’s move on to the house hacking part, shall we?

Should You House Hack a Condo or House?

Often the decision of buying a house or condo depends on the person. Both have qualities that could be considered “bonuses” and “deal breakers” depending on the type of factors you desire in your future home.

You may love the idea of a house because you want a private yard, which you consider a necessity when looking for a home. But some people could see a yard as a deal breaker. They may not want the upkeep, and would rather have a communal outdoor area that is maintained and paid for by someone else.

The decision mainly comes down to personal preference. So, what are the main differences between the two?

Let’s look at some major differences often associated with a house and a condo:

It’s important to note that these aren’t set-in-stone factors that ALL houses and condos possess. Not all homes are alike, which will be so clear when you start searching for your home. Not all condos share a wall with their neighbor and have HOAs, just as not all houses have backyards and private driveways. But the above differences are still most common, and thus worth mentioning.

Now make sure, especially when it comes to condos with HOAs, that you know what to look for. Some buildings have higher fees than others, and some have more frequent fees (if they are older buildings). Each HOA is like their own government. They have their own rules and regulations! As you probably know, even some neighborhoods have HOAs, so you may find a home that also has HOA fees.

So now, after looking at the more common differences between a house and a condo, are you leaning towards one or the other?

Before you make the decision in your head, let’s compare two on-the-market in Austin homes and see which in these cases is the better house hacking option for you. Before we show you, we want to emphasize that these are tactics you can utilize anywhere in the world! We are using our home base in Austin because we have better access to these homes.

House VS Condo

To make it easier to compare the house and condo, we will make the search criteria the same. Both homes are:

in the 78745 zip code

Between $300-$350k

Over 1,000 square feet

At least 2 bed / 2 (1.5) baths

Require little to no major renovations

On the market as of 4/1/20 (*examples may be off the market as you read this)

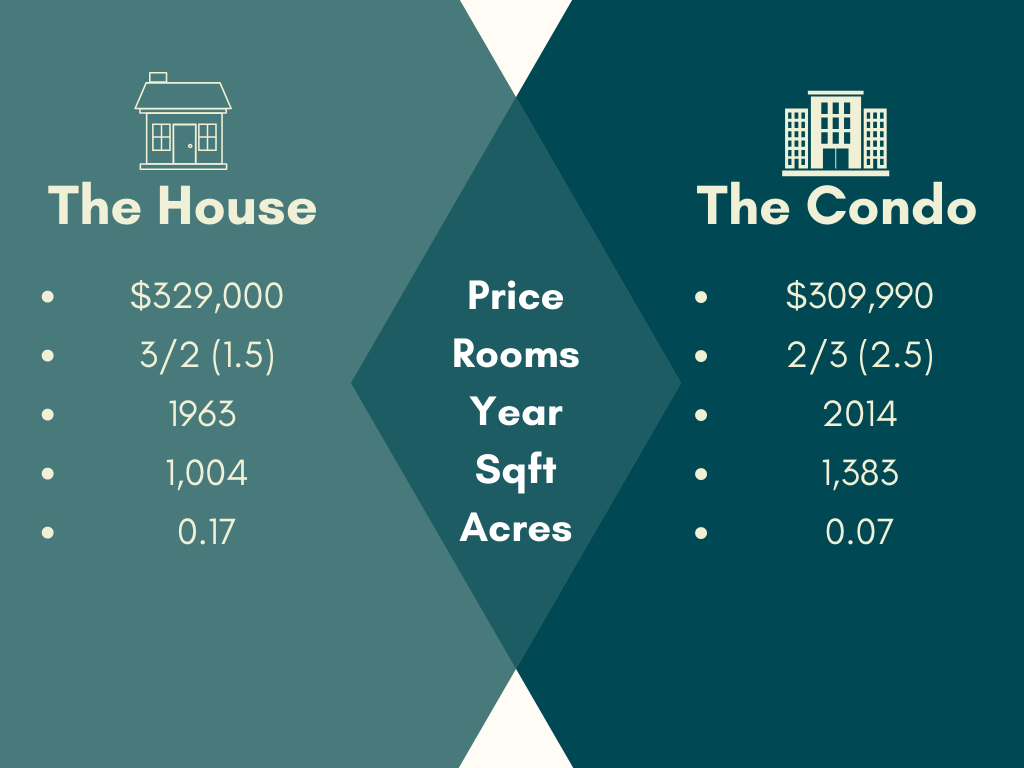

Now let’s see the two homes:

House for Sale

Condo for Sale

Would you rather buy the house because you have 3 bedrooms and a yard? Or would you rather buy the condo because each person has their own bathroom and no yard maintenance?

But the numbers above aren’t enough factors to base a decision on. Let’s look at the numbers on the mortgage calculators below to see if we can get some clarity! For both options, we are assuming we are putting 5% as our down payment and our interest rate is 3.5% (*interest rates may have changed since this blog post was written).

The House

WITH A 5% DOWN PAYMENT OF $16,450, AN INTEREST RATE OF 3.5% AND ESTIMATED TAXES FOR THE YEAR AT $5,735…

YOUR MONTHLY PAYMENTS WOULD BE $1,881.

The Condo

WITH A 5% DOWN PAYMENT OF $15,499 AND AN INTEREST RATE OF 3.5%, AND ESTIMATED TAXES FOR THE YEAR AT $6,314…

YOUR MONTHLY PAYMENTS WOULD BE $1,848.

With a 5% down payment and 3.5% interest rate, both places would have similarly priced monthly mortgage payments. The house’s mortgage is $1,881 and the condo’s is $1,848, there is only a $33 difference between them. With these numbers, a $33 difference isn’t enough to base the decision on.

Now let’s look at ways to hack the house and condo:

House hacking option 1: Rent 2 Bedrooms

The option above reflects house hacking with 2 roommates that pay $750 each to rent out 2 of your 3 bedrooms. In this scenario, you are really only paying $381 dollars a month on your mortgage payments. That’s only $4,572 in payments and $18,000 in savings a year! What could you do with $18,000?!

But if you don’t like the idea of a full house, it’s also easy to calculate what this house hacking scenario would look like with only 1 roommate. If you charged that same price, you’d be paying $1,131 a month on your mortgage payments. Although that’s a lot more than $381, you get the added benefit of an extra room for personal use (office? home gym?). In a rental situation, think about how often you could afford your own bedroom, bathroom, and spare room for $1,131. It’s not common!

Here is Option 2:

House hacking option 2: airbnb 1 room

The second option is for all of you who may not want full time roommates. This option allows more flexibility for the times when you want to live alone or want to charge more for events like SXSW. In this example there is one spare bedroom rented through Airbnb. You can choose to rent the room for however many days a month, at a price you deem reasonable.

Now let’s say you charge $80 a night for 15 nights. You would be making $1,200 per month to go toward your mortgage payments. In this house hacking scenario, you end up paying, on average, $681 a month on your own.

With this option you could also end up MAKING money and not having to pay any part of your mortgage. Let’s say you had a great month where your room was occupied 25 days. You then received around $2,000 dollars from Airbnb. Subtract your $1,881 mortgage payment, and you made an extra $119 dollars that month. It really depends month by month how well you do, but the good months often offset the bad.

Now that we’ve seen two examples of house hacking in a home, let’s see Option 1 for a condo:

House hacking option 1: rent bedroom

In this house hacking scenario, you are renting 1 of your 2 bedrooms in your condo. If you rent the bedroom at $948 a month, your monthly payment would be $900 dollars. Your yearly rent payment is then $10,800, and you save $11,376 a year.

Since this additional bedroom has it’s own private bathroom, you are able to charge a little more than if they had to share with a couple people.

Although you save less in this option than with the house, you still save a lot of money. You are also able to split your mortgage roughly down the middle, and rather than spending $900 a month on rent you’ll never see again, it is going into building equity on your home.

Now let’s look at Option 2:

House hacking option 2: airbnb bedroom

Now let’s look at what would happen if you Airbnb’ed a room in your condo. To be consistent, we looked at Airbnbing through the same amount of time and money as the house (15 days, $80 per night). Thus, both places received the same amount of money, $1,200, from Airbnb income. If you plan to Airbnb a room in your condo, you must look through the HOA documents to make sure that your HOA allows short-term rentals.

In this scenario, that makes your monthly mortgage payments $648 dollars. When comparing this to the previous rental option 1 - this is the one that seems to make more money. $648 per month is a bit less than rental option 1’s $900. In option 2 you are saving an additional $252 a month; that is $3,024 a year.

If your goal is to save as much as possible, then option 2 is looking like the better option. But a reminder that 15 days is the average, and some months you could make way more, or even nothing at all. However, it does allow you to have a renter whenever you want, and have a lot more living freedom.

After weighing all 4 options, which one is the best?

There is no right answer for everyone! It depends on your needs, situation, and wants. So let’s see which options are best to fill certain needs:

If you want the lowest monthly payment: House Option 1

Pros: $381 a month and only $4,572 a year

Cons: 2 roommates, full house, potentially higher utilities

If you want the most privacy: Condo Option 2

Pros: Can live alone most of the month and decide when you want an Airbnber, you can make more than your mortgage payments if you rent it out a lot

Cons: Inconsistent income, if you are wary of strangers you will not be comfortable

So it’s safe to say the “best” option depends on the person looking for the home. A house or a condo can both be great house hacking options - you just have the find the one that allows you to house hack in a way that fits your needs.

Ready to find an agent in Austin or elsewhere in the US to help you on your journey? We’ve got you!